●● Commuter Benefits

smooth sailing

Flexible, Compliant, Handy, Savvy.

What more could you want in a commuter benefits plan?

Our commuter plans help maximize tax savings for you and participants while also reducing input from your HR/benefits team. Plus, they’re crafted to be compliant with tax laws and commuter mandates across the nation, and protected with data security that meet the toughest standards, including GDPR.

We develop commuter and transit benefit plans to help overcome the challenges of getting to work each day. Just like we’ve done for more than 30 years.

Companion to More Than 1 Million Employees

and 10,000+ Companies Nationwide

Why Offer Commuter Benefits?

Currently, nine U.S. metros mandate transit benefits, but employers in other locations often offer Edenred’s robust commuter benefits to:

- Differentiate their employer brand for retention and recruiting

- upport sustainable and green commuting initiatives and missions

- Promote in-office and hybrid schedules

- Cut employee out-of-pocket commuting costs through optional employer contributions

- Set aside commuting funds for employees with pre-tax deductions

- Reduce employer payroll taxes

- Cover additional commuting options through Microbility Benefits

Download our free guide, Commuter Benefits 101.

Estimate your savings:

how much could your company save?

Input the number of participating employees to see the potential payroll tax savings.

Number of employees

Potential annual cost savings

Discover how Edenred meets your company’s goals and values

On-the-go app

Pre-loaded debit card

Single login for app and web benefits portal

Dedicated customer service for participants thru chat or phone

Integration with all major payroll systems

Migrate from current benefits plan with ZERO downtime

World-class tech and support teams for HR, IT, employer

Micromobility add-on for more commuting options

What’s Covered?

Pre-tax benefits

Public transit, including bus, train, ferry

Vanpools

Parking plus discount thru SpotHero, where available

Micromobility options (post-tax benefits)

Bike sharing

E-scooter, e-bike, and moped rentals

Bicycle equipment and repairs thru partner shops

Corporate shuttles

Edenred’s Guaranteed Ride Home

Pre-tax and other savings for employees and employers

Employees save taxes on up to $600 monthly…

And save even more with exclusive partner discounts

Employers save on payroll taxes

How One Commuter Plan Works Across Your Organization

Employees

HR / Benefits Team

Employer Brand

Green Initiatives

Legal

Make Sustainable Commuting Part of Your Employer Brand with Micromobility

For commuters who travel just 20 miles daily for work, switching from single-car occupancy to public transit results in a reduction of 4,800 pounds of CO2 emissions per year.

Our Micromobility add-on includes

![]() Bike shops

Bike shops

![]() E-bike, e-scooter, and e-moped rentals

E-bike, e-scooter, and e-moped rentals

![]() Exclusive partner discounts

Exclusive partner discounts

![]() Corporate shuttles

Corporate shuttles

Micromobility add-on

Offer more choices to the daily commute

With Edenred’s Micromobility add-on, employees access even more commuting benefits post-tax, whether they hop on a scooter for an appointment down the block or use an alternative, sustainable ride to cover the final mile.

So many options!

![]()

Rent e-scooters and mopeds

![]()

Take a personal bike into a

partner shop for quick repairs

![]()

Purchase biking gear or a whole new bike

![]()

Commute with the team on a corporate shuttle

![]()

Hop on an e-bike to reach an

early morning meeting on time

![]()

Catch an Edenred Private Ride

with Lyft

How it works

Employees use their Edenred card and app to access exclusive partner discounts, book private rides with the Edenred-only pricing, and even pay with post-tax commuting subsidies, if selected by employer. And it’s all managed by the employee through the same system and login as their pre-tax Commuter Benefits plan.

Commuting is even more affordable with exclusive Edenred partner discounts

No more questions about how to pay

Micromobility add-ons are accessed thru the same system, same card as Edenred’s Commuter Benefits. Plus employees can add a personal debit or credit card to pay for expenses not covered by their benefits plans.

✓ Seamlessly interfaces with all Edenred Benefit Plans

✓ Covers the final mile with post-tax funds

✓ Plans that differentiate your employer brand

✓ More options, partners, and discounts coming soon!

See Edenred’s Commuter Benefits and Micromobility add-on in action

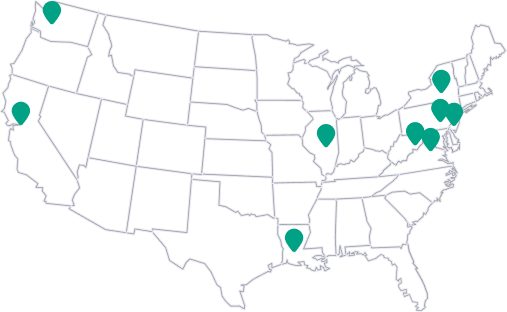

Commuter benefits that meet local mandates and ordinances

✓ Seattle

✓ New Jersey (statewide)

✓ New York City

✓ Washington, DC

✓ Berkley & Richmond, CA

✓ San Francisco Bay Area

✓ Chicago (January 2024)

Secure financial transactions

●● ●

Why do companies choose Edenred Commuter Benefits?

“We needed a commuter plan but wanted something that would also boost employee retention and acquisition — a commuter plan unlike anything else in the market…”

Read the story to see why Edenred was the natural fit.

Edenred is a global, leading services and payments platform providing a wide-range of workplace solutions including Commuter Benefits, LSAs, Anytime Pay, and Claims Reimbursement that work seamlessly together to make employees’ days a little nicer.

- 10,000+ U.S. employer employers

- 1 million U.S. employee participants

- Global presence, operating in 45 countriesADA-compliant employee portal

Want to provide Edenred’s Commuter Benefits to your team?

FAQs about Edenred’s Commuter Benefits plans

Can Edenred’s Commuter Benefits plan integrate with my payroll company?

If I provide an employer subsidy for commuting, will unused funds be returned to the company when an employee leaves?

How and where does the Edenred Prepaid Card work?

Edenred’s Prepaid Card can be used at any compliant location that sells transit or parking items only. While an employee cannot use their Edenred card to purchase a transit pass at a local convenience store, they can use it to purchase a transit card at a transit vending machine.

Can pre-tax parking and transit benefits be used for non-work commuting?

Is a commuter benefit worth it if I’m not mandated to provide it to my employees?

- Save on payroll taxes (employers may save up to $40 a month for each participating employee)

- Support green and sustainable commuting initiatives

- Differentiate the employer brand in markets where commuter benefits aren’t mandated

- Differentiate employer brands with the Micromobility add-on in markets where commuter benefit mandates exist

- Encourage return-to-office or transitions to hybrid scheduling for employees

What’s the difference between transit benefits and commuter benefits?

Is Edenred’s Micromobility add-on paid with pre-tax dollars?

No. Only the Commuter Benefits solution uses pre-tax dollars for commuting expenses (up to $315 monthly for public transit and $315 monthly for parking). The Micromobility add-on consists of post-tax benefits.