●●

Employee Benefits That Check Every Box

✓ Simplify daily commutes

✓ Reduce HR administration time

✓ Encourage green commuting

✓ Offer best-in-class LSA

✓ Embrace individuality

✓ Enhance employer brand

✓ Boost employee retention

✓ Provide benefits employees want to use

Enriching 10 Million Employee Lives Daily

and 10,000+ Companies Nationwide

●● ●

Commuter Benefits, LSA, Meal Allowance, and Related Payment Solutions

Benefits that enrich employees’ days and enhance your employer brand

Human-centric plans

Trusted worldwide

Technology-driven anywhere, anytime

Customization and more

All benefits plans can be customized to match employer missions and goals, and have compliance, flexibility, discounts, and extra perks baked in.

10,000

client companies

35 Years

of experience

1 Card

to access everything

1 App

to manage all benefits

Benefits Solutions

Commuter Benefits

Green, pre-tax, intuitive,

and compliant

Micromobility (add-on)

More choices to cover more commuters

Lifestyle Spending Accounts (LSA)

Individual, diverse, and unique,

like your team

Ticket Restaurant

Who wouldn’t love a

pre-paid meal?

AnytimePay

Employees decide when

it’s payday

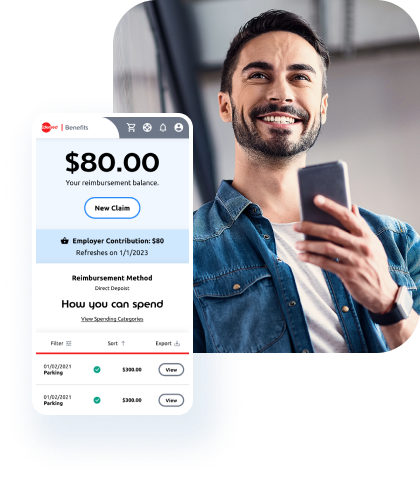

Claims Reimbursement

Accurate, automated,

and hassle-free

How Edenred Benefits

Plans Work

Compliance So You Know You’re Protected

Data security

Adheres to the strictest regulations worldwide, including GDPR, and other local requirements, plus FDIC insured, SOC 2 Type II certified, and PCI compliant

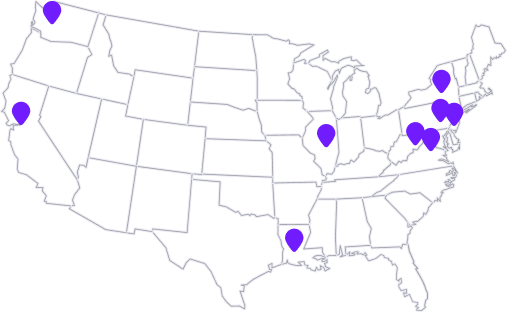

Commuter regulations

Meet ordinances in each of the following U.S. markets with employer mandates

- Philadelphia

- Seattle

- New Jersey

- New York City

- Washington, DC

- Los Angeles

- Berkley & Richmond, CA

- San Francisco Bay Area

- Chicago (regulation goes into effect January 2024)

Pre-tax expenditures

Extensive compliance database improves accuracy of pre-tax expense approvals complying with section 132(f) of the IRS tax code

Privacy and security protocols

In-house customer support and fulfillment allows for constant monitoring of security protocols

Why Do Employers

Choose Edenred Benefits?

Read Their Stories

Our clients include some of the worlds’ biggest household names, small-but-mighty tech organizations, healthcare heroes, and just about everyone in between. All have something in common: a desire to provide their teams with flexible and innovative benefits that go beyond expected. Read their stories.

![]()

Boost employee retention and acquisition with a plan unlike anything else in the market.

![]()

Switch to commuter benefits that would go further than just “compliance”.

![]()

Encourage employees to switch from drive-and-park to greener commuting options.

![]()

Offer a wellness plan that encourages individual choice and personal wellbeing.

![]()

Meet local regulations with wide-ranging benefits that match a large and diverse workforce.

We Create Benefits to Enhance Employee’s Days and Employer’s Brands

Clients, partners, participants, and communities are at the heart of the employee benefits plans we develop.

We offer options that go beyond “expected” so our plans can meet local requirements and engage employees, differentiate employer brands, and continually evolve to keep up with today’s workforce and tomorrow’s too.

Learn more about Edenred →

Latest articles

Keep Your Remote Employees Engaged With Employee Benefits

Why Offering Benefits to Remote Employees Is a Good Thing With over a third of the nation working remotely and more than 40% doing remote and hybrid work, it is predicted that by 2025 one out of five Americans will work remotely. The Covid pandemic might have ended,...

The Complete Guide to Improving Employee Engagement in 2024

How to Measure and Improve Employee Engagement in 2024 According to a Gallup poll taken in January of this year, "employees still feel more detached from, and less satisfied with, their organizations and are less likely to connect to the companies’ mission and purpose...

How to Resolve and Manage Conflict in the Workplace

Conflict in the Workplace: How Lifestyle Benefits Can Help Conflict in the workplace can arise from various sources, ranging from communication breakdowns to a difference of opinions, and it is crucial for organizations to set ground rules to address these issues...

●● ●

Schedule a 15-minute call to learn more about offering Edenred Benefits to your team.

FAQs about Edenred Benefits

Do Edenred's solutions integrate with my company’s HRIS?

Is there a customer service or support team to help with questions about our benefits plans?

Which companies offer Edenred Benefits?

Edenred Benefits are offered by more than 10,000 businesses in the United States and more than 30 million in 45 countries worldwide. You’ll find some big names on that list, including Meta, Intuit, Harvard University, the New York Times, Merck, Motorola, and Amazon.

Do I need to offer all benefits plans or can I select just a single benefit solution to offer my team (ex: LSA)?

Edenred supports clients of all sizes and needs, whether the company wants to offer just a single solution, like Commuter Benefits, or a fully integrated suite of benefits for their employees.